Can You Link a Credit Card to Cash App? A Deep Dive

The question of whether you can you link a credit card to Cash App is a common one for users looking to maximize the app’s functionality. Cash App has revolutionized how we handle peer-to-peer payments, but understanding its limitations and capabilities with credit cards is crucial for a seamless experience. This comprehensive guide will delve into the intricacies of linking credit cards to Cash App, exploring the benefits, limitations, potential fees, and best practices. We aim to provide a definitive resource, ensuring you can confidently navigate Cash App’s features and optimize your financial transactions.

This article goes beyond the surface-level answers found elsewhere. We’ll explore the nuances of using credit cards with Cash App, offering insights into maximizing rewards, avoiding fees, and understanding the security implications. Whether you’re a seasoned Cash App user or just getting started, this guide will empower you with the knowledge to use the platform effectively and responsibly.

Understanding the Basics of Linking a Credit Card to Cash App

Linking a credit card to Cash App is a relatively straightforward process, but understanding the underlying mechanics is essential. Cash App allows users to link various funding sources, including bank accounts and debit cards. While credit cards can also be linked, their functionality is more limited compared to other options. It’s important to differentiate between linking a credit card for sending payments versus adding funds to your Cash App balance.

Core Concepts:

- Funding Source: When you link a credit card, it becomes a funding source for sending payments to other Cash App users.

- Limitations: Credit cards cannot be used to add funds directly to your Cash App balance. This is a key distinction to remember.

- Fees: Cash App typically charges a fee when you send money using a credit card. This fee is designed to cover the processing costs associated with credit card transactions.

The ability to link a credit card offers convenience, allowing users to send payments even when they don’t have sufficient funds in their bank account or Cash App balance. However, understanding the associated fees and limitations is crucial to avoid unexpected charges and optimize your Cash App experience.

Cash App: A Digital Payment Powerhouse

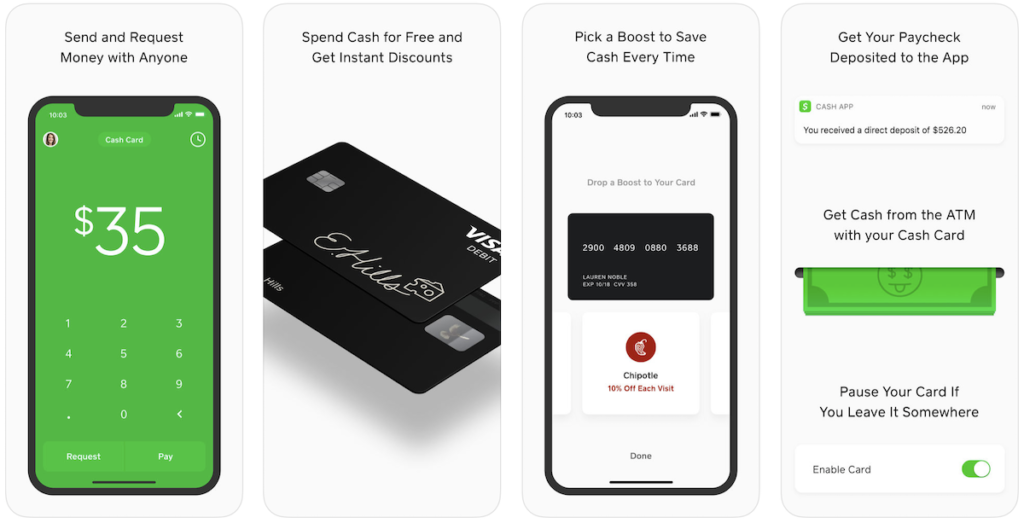

Cash App, developed by Block, Inc. (formerly Square, Inc.), has become a dominant player in the mobile payment landscape. Its core function is to facilitate peer-to-peer money transfers, allowing users to send and receive funds quickly and easily using their smartphones. Beyond this core functionality, Cash App offers a range of features, including:

- Cash Card: A customizable debit card linked to your Cash App balance, allowing you to make purchases online and in-store.

- Investing: The ability to buy and sell stocks and cryptocurrencies directly within the app.

- Direct Deposit: Users can set up direct deposit to receive their paychecks directly into their Cash App account.

- Boosts: Instant discounts and rewards offered on purchases made with the Cash Card at select merchants.

Cash App’s widespread adoption is due to its user-friendly interface, convenient features, and integration with various financial services. Its ability to adapt to evolving user needs and embrace new technologies has solidified its position as a leading digital payment platform.

Analyzing Key Features of Cash App

Cash App’s popularity stems from its intuitive design and versatile features. Let’s break down some of the key functionalities and their benefits:

- Peer-to-Peer Payments:

- What it is: The core function of Cash App, enabling users to send and receive money instantly.

- How it works: Users link their bank accounts, debit cards, or credit cards to their Cash App account and can then send or request money from other users using their $Cashtag or phone number.

- User Benefit: Eliminates the need for cash or checks, making it easy to split bills, pay friends and family, or send gifts.

- Cash Card:

- What it is: A Visa debit card linked to your Cash App balance.

- How it works: Users can order a physical Cash Card or use a virtual card for online purchases. The card draws funds directly from their Cash App balance.

- User Benefit: Provides a convenient way to spend your Cash App balance in the real world, both online and in stores.

- Investing:

- What it is: Allows users to buy and sell stocks and cryptocurrencies.

- How it works: Users can invest with as little as $1, making it accessible to beginners.

- User Benefit: Provides an easy way to participate in the stock market and cryptocurrency markets directly from their phone.

- Direct Deposit:

- What it is: Allows users to receive their paychecks directly into their Cash App account.

- How it works: Users can obtain their account and routing number from Cash App and provide it to their employer.

- User Benefit: Offers a convenient and secure way to receive paychecks, potentially faster than traditional methods.

- Boosts:

- What it is: Instant discounts and rewards offered on purchases made with the Cash Card at select merchants.

- How it works: Users can activate Boosts within the app and then use their Cash Card to make purchases at participating merchants.

- User Benefit: Saves money on everyday purchases, making the Cash Card even more valuable.

Unlocking the Advantages and Benefits of Using Cash App

Cash App offers a multitude of advantages and benefits that cater to a wide range of users. Here are some of the most significant:

- Convenience and Speed: Sending and receiving money is incredibly fast and easy, eliminating the need for physical cash or checks.

- Accessibility: Cash App is available on both iOS and Android devices, making it accessible to virtually anyone with a smartphone.

- Versatility: Cash App offers a range of features beyond basic payments, including investing, direct deposit, and Boosts.

- Security: Cash App employs various security measures, such as encryption and fraud detection, to protect user data and funds.

- Customization: Users can personalize their Cash Card and $Cashtag, adding a personal touch to their financial transactions.

- Rewards and Discounts: Boosts offer valuable discounts and rewards on everyday purchases, saving users money.

- Financial Inclusion: Cash App provides access to financial services for individuals who may be underserved by traditional banks.

Users consistently report that Cash App simplifies their financial lives, making it easier to manage money, send payments, and invest. Its user-friendly interface and comprehensive features make it a valuable tool for anyone looking to streamline their finances.

A Detailed Look at Credit Card Usage with Cash App

While linking a credit card to Cash App offers convenience, it’s crucial to understand the nuances and limitations involved. Unlike debit cards or bank accounts, credit cards incur fees when used to send payments. These fees are typically around 3% of the transaction amount. This is an important consideration for users who frequently send money via Cash App.

Pros of Linking a Credit Card:

- Convenience: Allows you to send payments even when you don’t have sufficient funds in your Cash App balance or bank account.

- Rewards: You may be able to earn credit card rewards (e.g., points, miles, cashback) on payments sent via Cash App.

Cons of Linking a Credit Card:

- Fees: Cash App charges a fee (typically 3%) for sending payments with a credit card.

- No Balance Loading: You cannot use a credit card to add funds directly to your Cash App balance.

- Potential for Debt: Using a credit card to send payments can lead to debt if you don’t pay off your balance in full each month.

Ideal User Profile:

Linking a credit card to Cash App is best suited for users who:

- Need to send a payment urgently and don’t have sufficient funds available elsewhere.

- Are confident in their ability to pay off their credit card balance in full each month to avoid interest charges.

- Value the convenience of using a credit card over the cost of the transaction fee.

Alternatives:

Alternatives to using a credit card for Cash App payments include:

- Debit Card: Linking a debit card is generally the most cost-effective option, as there are no fees for sending payments.

- Bank Account: Linking your bank account allows you to send and receive money directly, often without fees.

Based on our analysis, using a credit card with Cash App is a viable option in certain situations, but it’s essential to weigh the convenience against the associated fees and potential for debt. For most users, linking a debit card or bank account is a more cost-effective and responsible approach.

Navigating the Landscape of Digital Payments

In conclusion, while can you link a credit card to Cash App, it’s a functionality best used with careful consideration. Understanding the associated fees and limitations is paramount to maximizing the app’s benefits without incurring unnecessary costs. Cash App remains a powerful tool for peer-to-peer payments, offering a range of features that simplify financial transactions. By making informed decisions about funding sources, users can optimize their experience and leverage the full potential of this innovative platform.

We encourage you to share your experiences with using credit cards on Cash App in the comments below. Your insights can help others navigate the platform more effectively and make informed decisions about their financial transactions.