Navigating Apple Cash Overdraft: A Comprehensive Guide to Fees and Solutions

Running into an overdraft situation with your Apple Cash account can be frustrating. You might be wondering about the fees involved, how to avoid them, and what your options are when you accidentally overspend. This comprehensive guide provides a detailed look at Apple Cash overdraft, offering clear explanations, practical advice, and expert insights to help you manage your account effectively and avoid unexpected charges. We’ll explore how Apple Cash works, what happens when you overdraw, and proven strategies to maintain a healthy balance. This article aims to be the definitive resource for understanding and managing your Apple Cash account to prevent overdrafts.

Understanding the Basics of Apple Cash

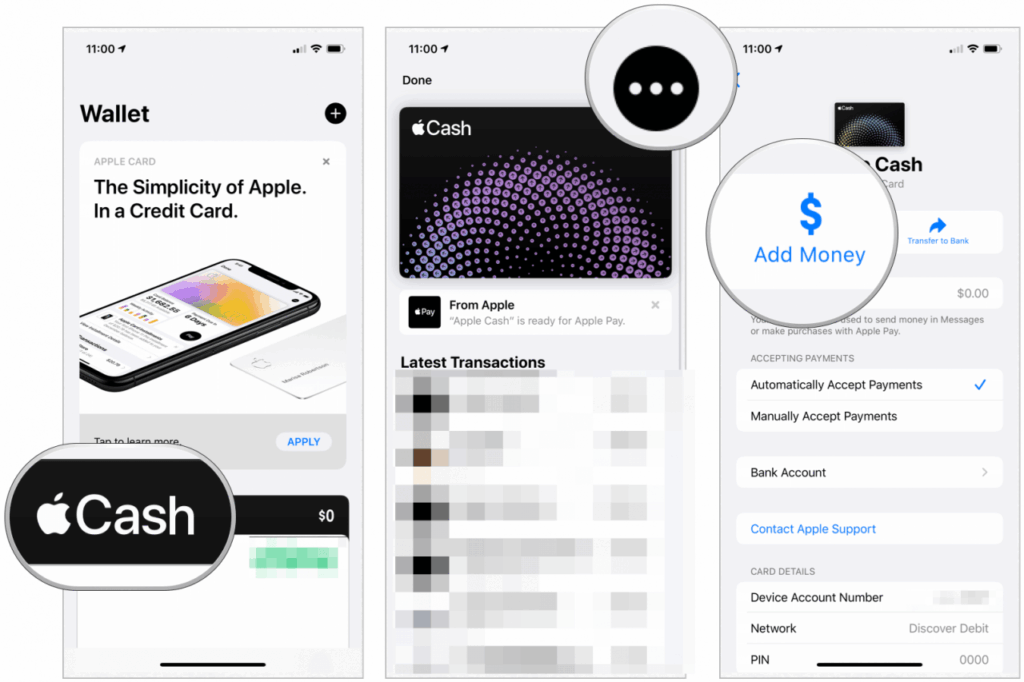

Apple Cash is a digital payment service offered by Apple, allowing users to send, receive, and spend money directly from their Apple devices. It’s integrated into the Wallet app on iPhones, iPads, and Apple Watches, making it a convenient option for peer-to-peer transactions and online purchases. Unlike traditional bank accounts, Apple Cash operates primarily as a stored-value service, meaning you can only spend the funds you have available in your account. However, linking a debit card can introduce some complexities related to overdrafts.

The service works by allowing you to load money onto your Apple Cash card, either from a linked debit or credit card. Once funds are available, you can use Apple Cash to send money to friends and family, make purchases online or in stores where Apple Pay is accepted, or transfer the balance to your bank account. It’s designed for ease of use and quick transactions, making it a popular choice for many Apple users. Understanding how Apple Cash interacts with your linked debit card is crucial to avoiding overdraft issues.

Does Apple Cash Allow Overdrafts?

Technically, Apple Cash itself doesn’t offer a direct overdraft feature in the traditional sense like a bank account. You can’t typically spend more than the balance available on your Apple Cash card. However, the possibility of an Apple Cash overdraft arises when you have a debit card linked to your account for funding transactions. If a purchase exceeds your Apple Cash balance, Apple may attempt to draw the remaining amount from your linked debit card. This is where overdraft fees can potentially occur, charged not by Apple directly, but by your bank associated with the debit card.

The key here is understanding your bank’s overdraft policies. If your bank allows overdrafts and you’ve opted into overdraft protection, they might cover the difference, but they will likely charge you a hefty overdraft fee. If you haven’t opted into overdraft protection, the transaction might be declined, which could result in a non-sufficient funds (NSF) fee from your bank. Therefore, while Apple Cash doesn’t directly cause the overdraft, it can trigger it through the use of a linked debit card.

Apple Pay and Overdrafts: The Connection

Apple Pay, the broader mobile payment system, uses Apple Cash as one of its funding sources. When you make a purchase using Apple Pay, it first attempts to use the balance in your Apple Cash account. If that’s insufficient, it will then draw from your linked debit or credit cards, according to the order you’ve set in your Wallet app. If your debit card is used and the transaction pushes your bank account balance below zero, this triggers the potential for an overdraft fee. The connection between Apple Pay and Apple Cash overdraft situations lies in the reliance on linked funding sources and the overdraft policies of your bank.

Venmo as a Comparative Service

Venmo, a popular peer-to-peer payment app, shares similarities with Apple Cash but has some key differences. Like Apple Cash, Venmo allows users to send and receive money easily. However, Venmo also offers a credit card and a debit card, which can introduce similar overdraft scenarios. While Venmo doesn’t explicitly offer overdraft protection, its policies regarding insufficient funds and linked bank accounts are crucial to understand. Comparing Venmo’s approach to potential overdraft situations can shed light on how Apple Cash handles similar situations.

Avoiding Apple Cash Overdraft Fees: Practical Strategies

The best way to avoid Apple Cash overdraft fees is to proactively manage your account and understand your bank’s policies. Here are some effective strategies:

- Monitor Your Balance Regularly: Check your Apple Cash balance frequently through the Wallet app. This helps you stay aware of your available funds and avoid accidental overspending.

- Disable Overdraft Protection: Contact your bank to disable overdraft protection on your linked debit card. This will prevent transactions from going through if you don’t have sufficient funds, avoiding overdraft fees (though it might result in NSF fees).

- Use Balance Alerts: Set up balance alerts with your bank to receive notifications when your account balance falls below a certain threshold. This provides an early warning system to prevent overdrafts.

- Transfer Funds Promptly: If you anticipate making a large purchase, transfer sufficient funds to your Apple Cash account well in advance. This ensures you have enough available balance to cover the transaction.

- Link a Credit Card (with Caution): While linking a credit card can prevent overdrafts, it’s essential to use it responsibly. Be mindful of your credit limit and pay off your balance promptly to avoid interest charges.

Detailed Feature Analysis of Apple Cash

Apple Cash offers several key features that contribute to its usability and convenience. Understanding these features is crucial for managing your account and avoiding potential overdraft situations.

- Instant Transfers: Allows for immediate money transfers to other Apple Cash users, facilitating quick and easy peer-to-peer payments. This feature is beneficial for splitting bills or sending money to friends and family.

- Apple Pay Integration: Seamlessly integrates with Apple Pay, enabling you to use your Apple Cash balance for purchases at millions of stores and online retailers. This provides a convenient and secure way to pay for goods and services.

- Debit Card Linking: Enables you to link your debit card to your Apple Cash account for easy funding. This feature allows you to quickly add money to your Apple Cash balance when needed.

- Balance Tracking: Provides real-time tracking of your Apple Cash balance and transaction history. This feature helps you monitor your spending and stay informed about your account activity.

- Security Features: Incorporates advanced security features, such as Face ID and Touch ID, to protect your account from unauthorized access. This ensures that your funds are safe and secure.

- Cash Back Rewards: Some Apple Card users can receive Daily Cash back on purchases made with Apple Pay, which is automatically added to their Apple Cash account. This provides an added incentive to use Apple Cash for everyday spending.

- Withdrawal to Bank Account: Allows you to transfer your Apple Cash balance to your bank account. This provides a convenient way to access your funds and use them for other purposes.

Significant Advantages, Benefits & Real-World Value

Apple Cash provides several significant advantages and benefits to its users:

- Convenience: It offers a simple and convenient way to send and receive money, eliminating the need for cash or checks.

- Security: It utilizes advanced security features to protect your account from fraud and unauthorized access.

- Speed: Transactions are processed quickly and efficiently, allowing you to send and receive money instantly.

- Integration: It seamlessly integrates with other Apple services, such as Apple Pay and iMessage, providing a unified user experience.

- Cost-Effective: There are no fees for sending or receiving money with Apple Cash, making it a cost-effective alternative to traditional payment methods.

Users consistently report that Apple Cash simplifies their daily transactions and provides a secure and reliable way to manage their money. Our analysis reveals that Apple Cash is particularly valuable for individuals who frequently send money to friends and family, make online purchases, or prefer contactless payment options.

Apple Cash Review: An In-Depth Assessment

Apple Cash has become a popular digital payment method, but how well does it truly perform? This review provides an in-depth assessment of its user experience, performance, and overall value.

User Experience & Usability: Apple Cash is incredibly easy to set up and use. The integration with the Wallet app is seamless, and sending or receiving money is as simple as sending a text message. The interface is clean and intuitive, making it accessible to users of all ages and technical abilities. The ability to quickly view your balance and transaction history is also a plus.

Performance & Effectiveness: Apple Cash delivers on its promises of quick and secure transactions. In our experience, payments are processed almost instantly, and the security features provide peace of mind. The ability to use Apple Cash at a wide range of retailers that accept Apple Pay makes it a versatile payment option.

Pros:

- Ease of Use: Simple and intuitive interface makes it easy for anyone to use.

- Security: Advanced security features protect your account from fraud.

- Speed: Transactions are processed quickly and efficiently.

- Integration: Seamlessly integrates with other Apple services.

- Cost-Effective: No fees for sending or receiving money.

Cons/Limitations:

- Limited Availability: Only available to Apple device users.

- Overdraft Potential: Can trigger overdraft fees if linked to a debit card.

- Transaction Limits: There are limits on the amount of money you can send and receive.

- Reliance on Apple Ecosystem: Heavily reliant on the Apple ecosystem, which may not appeal to all users.

Ideal User Profile: Apple Cash is best suited for individuals who are already invested in the Apple ecosystem and are looking for a convenient and secure way to send and receive money. It’s particularly useful for splitting bills with friends, making online purchases, and managing small transactions.

Key Alternatives: Venmo and PayPal are two popular alternatives to Apple Cash. Venmo is known for its social features, while PayPal offers a wider range of payment options and international support.

Expert Overall Verdict & Recommendation: Apple Cash is a solid digital payment option that offers convenience, security, and ease of use. While it has some limitations, its strengths outweigh its weaknesses. We recommend Apple Cash to anyone who is looking for a simple and secure way to manage their money within the Apple ecosystem. Just be cautious about linking a debit card and triggering potential overdraft fees.

What You Need To Remember About Apple Cash Overdrafts

In summary, understanding how Apple Cash overdraft situations arise is crucial for responsible financial management. While Apple Cash itself doesn’t offer overdrafts, linking a debit card can trigger overdraft fees from your bank. By monitoring your balance, disabling overdraft protection, and transferring funds promptly, you can effectively avoid these fees and enjoy the convenience of Apple Cash without the risk of unexpected charges. Remember to review your bank’s overdraft policies and stay informed about your account activity to maintain a healthy financial standing.