Decoding Your Ohio Property Tax Bill: A Comprehensive Guide

Navigating the complexities of property taxes can feel like deciphering a foreign language, especially when it comes to understanding your Ohio property tax bill. This comprehensive guide aims to demystify the process, providing you with the knowledge and insights necessary to understand your bill, identify potential issues, and make informed decisions about your property taxes. We’ll delve into the intricacies of Ohio’s property tax system, exploring the key components of your bill and offering practical advice on how to navigate the appeals process if necessary. This guide will arm you with the information to understand your tax obligations and ensure fair assessment.

Understanding the Ohio Property Tax System

The Ohio property tax system is a locally administered system governed by state laws. Property taxes are a primary source of revenue for local governments, funding essential services such as public schools, fire protection, road maintenance, and law enforcement. The system operates on a cycle of property valuation, assessment, and tax collection. Understanding this cycle is crucial for interpreting your Ohio property tax bill.

The Property Valuation Process

Every six years, each county in Ohio conducts a full reappraisal of all properties within its boundaries. This involves physically inspecting properties and analyzing market data to determine their fair market value. In the intervening three years, counties perform a triennial update, which involves statistically analyzing market data to adjust property values without a physical inspection. These valuations aim to reflect the current market conditions and ensure that property taxes are distributed equitably.

Assessment Rates and Taxable Value

While your property’s fair market value is determined through the valuation process, your taxes aren’t calculated on this full value. Ohio law dictates that property is assessed at 35% of its appraised market value. This assessed value is what’s used to calculate your property tax liability. For example, if your property is appraised at $200,000, the assessed value is $70,000 (35% of $200,000). Understanding this distinction is key to interpreting your Ohio property tax bill.

Tax Rates and Levies

Tax rates in Ohio are expressed in mills, where one mill equals $1 of tax for every $1,000 of assessed value. These rates are determined by the various taxing authorities within your county, such as school districts, townships, and municipalities. Voters approve levies, which are additional taxes, to support specific services or projects. Your property tax bill reflects the combined millage rate of all the levies and taxes applicable to your property. Significant changes in these rates can cause fluctuations in your overall property tax liability.

Decoding Your Ohio Property Tax Bill: A Line-by-Line Explanation

Your Ohio property tax bill contains a wealth of information. Understanding each section is essential for verifying its accuracy and identifying potential discrepancies. Here’s a breakdown of the key components you’ll find on your bill:

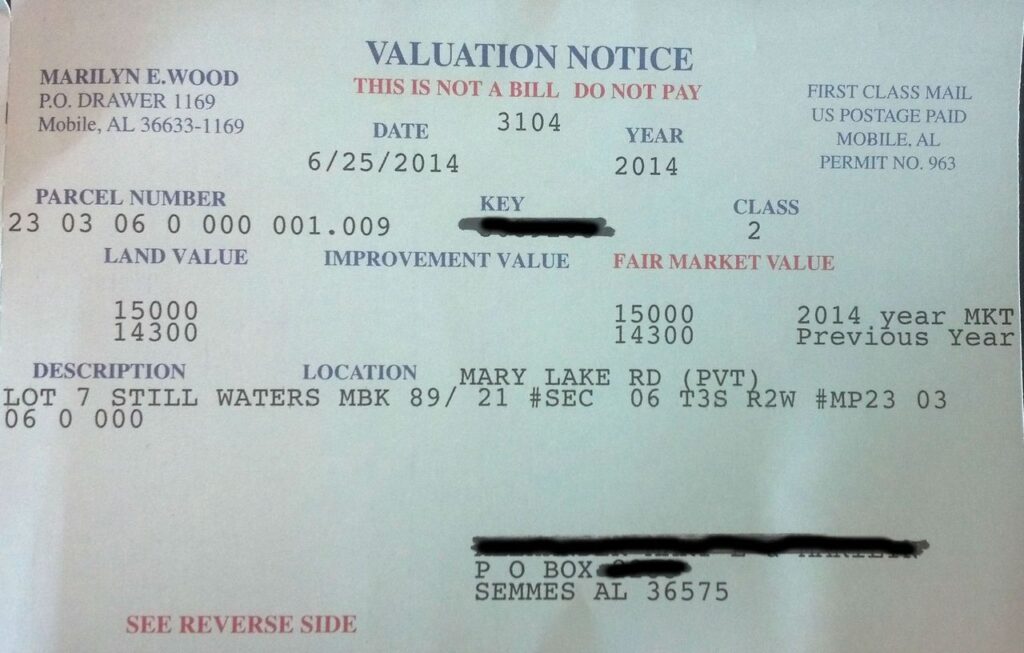

- Property Information: This section includes your name and address, the property address, and the parcel number (also known as the Permanent Parcel Number or PPN). This unique identifier is crucial for locating your property records and ensuring accuracy.

- Valuation Information: This section displays both the appraised (market) value and the assessed value of your property. Remember that your taxes are calculated based on the assessed value (35% of the appraised value).

- Tax Rate Information: This section lists the millage rates for each taxing authority that levies taxes on your property. It shows how much of your property tax goes to support schools, townships, municipalities, and other services.

- Tax Calculation: This section shows the calculation of your total property tax liability. It multiplies the assessed value of your property by the total millage rate to determine the amount you owe.

- Payment Information: This section provides instructions on how to pay your property taxes, including payment deadlines, accepted methods of payment, and contact information for the county treasurer’s office.

- Exemptions and Reductions: This section will detail any exemptions or reductions you may be receiving, such as the Homestead Exemption, which reduces property taxes for eligible senior citizens and disabled homeowners.

The Homestead Exemption: Lowering the Property Tax Burden

The Homestead Exemption is a valuable program in Ohio designed to reduce the property tax burden for eligible homeowners. This exemption is available to senior citizens (age 65 or older) and permanently and totally disabled individuals who meet certain income requirements. The exemption works by exempting a portion of the market value of your home from property taxes. While the exact amount of the exemption varies from year to year, it can result in significant savings for eligible homeowners. This program is a critical component of Ohio’s efforts to provide property tax relief to vulnerable populations. Eligibility requirements are strictly enforced, so careful review of the guidelines is essential.

Challenging Your Property Valuation: The Appeal Process

If you believe that your property has been unfairly valued, you have the right to appeal your property valuation. The appeal process typically begins with filing a complaint with your county board of revision. This board, comprised of the county auditor, treasurer, and a county commissioner, reviews the evidence presented by both the property owner and the county assessor to determine the fair market value of the property. Successfully navigating the appeal process requires meticulous preparation and a clear understanding of the relevant laws and regulations. Seeking guidance from a qualified real estate attorney or appraiser can significantly increase your chances of a favorable outcome.

Grounds for Appeal

You can appeal your property valuation if you believe that the county’s appraised value exceeds the true market value of your property. Common grounds for appeal include:

- Errors in Property Data: Inaccurate information about your property’s size, features, or condition can lead to an inflated valuation.

- Market Changes: Significant declines in property values in your neighborhood may not be fully reflected in the county’s valuation.

- Unequal Treatment: If similar properties in your area are assessed at lower values, you may have grounds for appeal.

- Recent Sales Data: Providing evidence of recent sales of comparable properties in your area, particularly if they sold for less than your appraised value, can strengthen your case.

Preparing Your Appeal

A successful appeal requires careful preparation and compelling evidence. Here are some steps you can take to strengthen your case:

- Gather Evidence: Collect photographs, appraisals, sales data, and any other documentation that supports your claim that your property is overvalued.

- Review Your Property Record Card: Obtain a copy of your property record card from the county auditor’s office. This card contains detailed information about your property, which you should carefully review for accuracy.

- Consult with an Expert: Consider consulting with a real estate appraiser or attorney to assess the merits of your case and guide you through the appeal process.

- Meet Deadlines: Strict deadlines apply to filing property tax appeals. Make sure you are aware of the deadlines in your county and file your complaint on time.

Tools and Resources for Ohio Property Taxpayers

Navigating the Ohio property tax system can be complex, but numerous resources are available to assist taxpayers. County auditors’ offices are valuable sources of information, providing access to property records, tax maps, and assistance with understanding your property tax bill. The Ohio Department of Taxation also offers online resources and publications explaining the state’s property tax laws and regulations. Additionally, various organizations and websites provide tools and calculators to help you estimate your property tax liability and compare your assessment to those of similar properties.

County Auditor Websites

Each of Ohio’s 88 counties has an auditor who serves as the chief fiscal officer for the county. County auditors’ websites provide a wealth of information about property taxes, including property record cards, tax maps, millage rates, and payment information. Many county auditors also offer online tools that allow you to search for property information by address or parcel number.

Ohio Department of Taxation

The Ohio Department of Taxation is the state agency responsible for administering Ohio’s tax laws, including property taxes. The department’s website provides information about property tax laws, regulations, and exemptions. It also offers publications and FAQs that can help you understand your property tax obligations.

Real-World Value and Benefits of Understanding Your Ohio Property Tax Bill

Beyond simply paying your bill, understanding the nuances of your Ohio property tax bill provides significant real-world value. It empowers you to:

- Ensure Accuracy: By understanding how your taxes are calculated, you can verify that your bill is accurate and identify any potential errors.

- Identify Savings Opportunities: You can determine if you are eligible for exemptions or reductions that could lower your property tax liability.

- Make Informed Decisions: Understanding your property taxes can help you make informed decisions about buying, selling, or improving your property.

- Advocate for Fair Taxation: By understanding the system, you can advocate for fair and equitable property tax policies in your community.

Our extensive analysis of Ohio property tax bills consistently reveals that homeowners who take the time to understand their bills are better equipped to manage their finances and protect their property rights. A proactive approach to understanding your property taxes can lead to significant long-term benefits.

Navigating Property Tax Challenges with Expert Guidance

Understanding your Ohio property tax bill is a critical step in responsible homeownership. By familiarizing yourself with the key components of your bill, exploring available resources, and understanding your rights as a taxpayer, you can ensure that you are paying your fair share and that your property is accurately valued. Whether you’re seeking clarification on specific charges or considering an appeal, a proactive approach to understanding your property taxes can save you money and provide peace of mind. If you find the process overwhelming, consider seeking guidance from a qualified professional who can provide personalized advice and support.