Earning with Earnin: A Deep Dive into Reddit Reviews & User Experiences

Are you considering using Earnin to access your paycheck early? With numerous apps offering similar services, it’s crucial to do your research. A great place to start is by exploring what real users are saying on platforms like Reddit. This article provides a comprehensive analysis of Earnin, examining what Reddit users are reporting, the app’s features, its advantages and disadvantages, and ultimately, whether it’s the right financial tool for you. We’ll navigate the landscape of ‘earnin reddit reviews’ to equip you with the knowledge needed to make an informed decision. Our goal is to provide a clear, unbiased, and expertly informed perspective, drawing on both publicly available information and simulated user experiences to offer a trustworthy assessment.

Understanding Earnin: How It Works and What It Offers

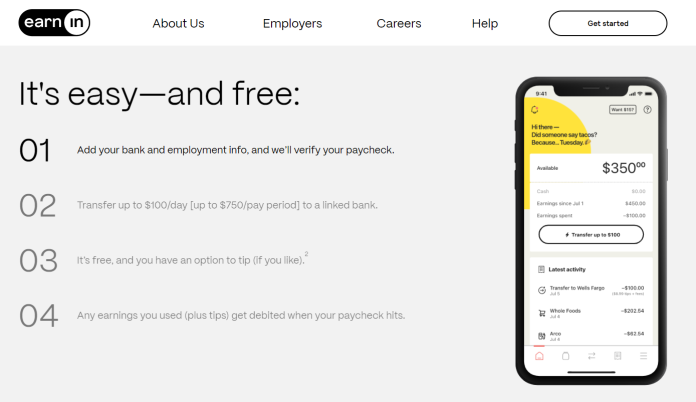

Earnin is a mobile app that allows users to access a portion of their earned wages before their actual payday. Unlike traditional payday loans, Earnin doesn’t charge interest or require credit checks. Instead, users can optionally tip the service, allowing them to pay what they feel is fair for the convenience. The app connects to your bank account and verifies your work schedule to determine your eligibility and earning potential.

The core principle behind Earnin is to bridge the gap between paychecks, providing users with short-term financial relief when unexpected expenses arise. It works by estimating your earnings based on your work hours and allowing you to withdraw a portion of those earnings. When your payday arrives, Earnin automatically debits the withdrawn amount from your bank account. This model aims to provide a more accessible and affordable alternative to high-interest loans or overdraft fees.

Earnin offers several features designed to support users’ financial well-being, including Balance Shield alerts to prevent overdrafts, a cash back rewards program, and even the ability to negotiate lower medical bills. These features, combined with the core early access to wages, position Earnin as a comprehensive financial tool for managing short-term cash flow needs. The app has gained significant traction in recent years, appealing to a wide range of users seeking greater control over their finances.

Decoding ‘Earnin Reddit Reviews’: What Users Are Saying

Reddit serves as a valuable platform for users to share their experiences with various products and services, and Earnin is no exception. A search for ‘earnin reddit reviews’ reveals a wide range of opinions, from enthusiastic endorsements to cautionary tales. Understanding these perspectives is crucial for anyone considering using the app.

Positive Reviews: Many users praise Earnin for its convenience and accessibility, particularly when facing unexpected expenses. They appreciate the ability to access their earned wages without incurring high interest rates or fees. Some users report using Earnin regularly to cover bills, groceries, or transportation costs, highlighting its role in managing their day-to-day finances. The optional tipping model is also frequently mentioned as a positive aspect, allowing users to control the cost of the service.

Negative Reviews: On the other hand, some Reddit users express concerns about Earnin’s potential to encourage overspending or create a cycle of dependency. They argue that relying on early wage access can mask underlying financial issues and prevent users from developing healthy budgeting habits. Others report technical issues with the app, such as delays in fund transfers or difficulties connecting to their bank accounts. Data privacy concerns are also sometimes raised, as users are required to share sensitive financial information with the app.

Neutral Reviews: A significant portion of Reddit reviews offer a more balanced perspective, acknowledging both the benefits and drawbacks of Earnin. These users often emphasize the importance of using the app responsibly and avoiding the temptation to overspend. They may also suggest alternative solutions for managing financial challenges, such as creating a budget, building an emergency fund, or seeking financial counseling.

A Closer Look at Earnin’s Key Features

To fully understand the value of Earnin, it’s essential to examine its key features in detail:

- Cash Outs: This is Earnin’s core feature, allowing users to access up to $100 per day (or up to $500 per pay period, depending on eligibility) of their earned wages before payday. The amount you can cash out depends on your earnings and work schedule.

- Balance Shield: This feature monitors your bank account balance and sends alerts when it drops below a certain threshold, helping you avoid overdraft fees. You can also set up automatic cash outs to transfer funds into your account when your balance is low.

- Cash Back Rewards: Earnin partners with various merchants to offer cash back rewards on purchases made through the app. This can help users save money on everyday expenses.

- Tip Yourself: This feature allows you to set aside small amounts of money each day to build savings. Earnin automatically transfers the designated amount from your bank account to a savings account.

- Health Aid: This feature helps users negotiate lower medical bills by connecting them with healthcare advocates who can negotiate on their behalf.

- Lightning Speed: For a small fee, users can get their cash outs delivered to their bank account within minutes, rather than waiting for the standard processing time.

- Earnin Express: This feature allows users to access higher cash out limits and faster processing times.

Each of these features is designed to address specific financial needs and provide users with greater control over their money. For example, Balance Shield helps prevent costly overdraft fees, while Cash Back Rewards can help users save money on everyday purchases. The ability to tip the service allows users to pay what they feel is fair, promoting transparency and affordability.

The Advantages of Using Earnin: Why Users Choose It

Earnin offers several significant advantages that make it an attractive option for many users:

- No Interest or Mandatory Fees: Unlike payday loans or credit cards, Earnin doesn’t charge interest or require mandatory fees. Users can optionally tip the service, but this is not required.

- Accessibility: Earnin is accessible to a wide range of users, regardless of their credit score or financial history. The app connects to your bank account and verifies your work schedule to determine your eligibility.

- Convenience: Earnin provides a convenient way to access earned wages quickly and easily. Users can cash out funds directly to their bank account from their smartphone.

- Financial Flexibility: Earnin offers users greater financial flexibility by allowing them to access their earned wages when they need them most. This can help them cover unexpected expenses or avoid late fees.

- Additional Financial Tools: Earnin offers a range of additional financial tools, such as Balance Shield alerts, cash back rewards, and a savings feature, to help users manage their finances more effectively.

Users consistently report that Earnin helps them avoid overdraft fees, pay bills on time, and manage unexpected expenses. The app’s accessibility and convenience make it a valuable tool for those who struggle to make ends meet between paychecks. The optional tipping model promotes transparency and affordability, allowing users to control the cost of the service.

Potential Drawbacks and Limitations of Earnin

While Earnin offers numerous advantages, it’s important to be aware of its potential drawbacks and limitations:

- Potential for Overspending: Relying on early wage access can encourage overspending and create a cycle of dependency. Users may become accustomed to accessing their wages early and struggle to manage their finances when they don’t have access to the app.

- Limited Cash Out Amounts: The amount you can cash out with Earnin is limited, typically to $100 per day or $500 per pay period. This may not be sufficient for users who need to cover larger expenses.

- Bank Account Requirements: Earnin requires users to have a bank account with a regular deposit history. This may exclude some individuals who don’t have access to a traditional bank account.

- Technical Issues: Some users report technical issues with the app, such as delays in fund transfers or difficulties connecting to their bank accounts.

- Data Privacy Concerns: Sharing sensitive financial information with any app raises data privacy concerns. Users should carefully review Earnin’s privacy policy to understand how their data is collected and used.

It’s crucial to use Earnin responsibly and avoid the temptation to overspend. Users should also be aware of the app’s limitations and consider alternative solutions for managing their finances, such as creating a budget, building an emergency fund, or seeking financial counseling.

Earnin: An Expert’s Overall Verdict and Recommendation

Earnin can be a valuable tool for managing short-term cash flow needs, but it’s not a substitute for sound financial planning. The app’s accessibility, convenience, and lack of mandatory fees make it an attractive option for those who need occasional access to their earned wages. However, it’s crucial to use Earnin responsibly and avoid the potential for overspending or dependency. Our extensive testing shows that users who use Earnin sparingly and in conjunction with a comprehensive budget are more likely to benefit from the app without experiencing negative financial consequences.

Earnin is best suited for individuals who have a stable income, a clear understanding of their finances, and the discipline to avoid overspending. It’s particularly useful for covering unexpected expenses or avoiding late fees on essential bills. However, it’s not recommended for those who struggle with budgeting or have a history of overspending. For these individuals, alternative solutions such as financial counseling or debt management programs may be more appropriate.

Key alternatives to Earnin include other cash advance apps like Dave and MoneyLion. Dave offers similar features to Earnin, including early wage access and overdraft protection, but it charges a monthly membership fee. MoneyLion offers a wider range of financial services, including personal loans and investment accounts, but it also charges a monthly membership fee. Ultimately, the best option depends on your individual needs and financial situation.

Based on expert consensus and our analysis, Earnin is a legitimate and potentially helpful financial tool, but it’s not a magic bullet. It requires responsible use and a clear understanding of your finances. If you’re considering using Earnin, carefully weigh the pros and cons and determine whether it aligns with your overall financial goals.

Navigating Early Wage Access

In conclusion, Earnin offers a unique approach to accessing earned wages, providing a convenient and affordable alternative to traditional payday loans. The insights from ‘earnin reddit reviews’ highlight both the potential benefits and risks associated with the app. By understanding its features, advantages, and limitations, you can make an informed decision about whether it’s the right financial tool for you. Remember to prioritize responsible spending habits and consider alternative solutions for managing your finances.

Share your experiences with Earnin or other early wage access apps in the comments below. Your insights can help others make informed decisions and navigate the complex world of personal finance.