How to Dispute a Cash App Transaction: Your Complete Guide to Resolution

Accidentally sent money to the wrong person? Were you charged for a service you didn’t receive, or suspect fraudulent activity on your Cash App account? Knowing how to dispute a Cash App transaction is crucial for protecting your funds and maintaining control over your digital finances. This comprehensive guide provides you with a step-by-step breakdown of the dispute process, equipping you with the knowledge and strategies you need to navigate disputes effectively and increase your chances of a successful resolution. We’ll delve into the nuances of Cash App’s dispute policies, explore various dispute scenarios, and offer expert advice to help you reclaim your funds. This is your ultimate resource for understanding and executing a Cash App dispute.

Understanding Cash App’s Dispute Resolution Process

Cash App, while convenient, doesn’t offer the same level of fraud protection as traditional credit cards. Understanding their dispute process is the first step in recovering potentially lost funds. Unlike credit card chargebacks governed by the Fair Credit Billing Act, Cash App disputes are handled internally, making it crucial to present a strong and well-documented case.

The Cash App dispute resolution hinges on several factors, including the type of transaction, the reason for the dispute, and the information you provide. It’s essential to act quickly, as there are time limits for initiating a dispute. Delays can significantly reduce your chances of a successful outcome. Furthermore, Cash App acts as an intermediary, investigating the claim and contacting the other party involved in the transaction. The outcome depends on the evidence presented by both sides and Cash App’s assessment of the situation.

Key Considerations Before Filing a Dispute

Before initiating a dispute, consider the following points:

- Attempt to Resolve the Issue Directly: Contact the recipient first. A simple misunderstanding might be resolved with a direct conversation.

- Gather Evidence: Collect all relevant documentation, such as screenshots of the transaction, receipts, and any communication with the recipient.

- Understand Cash App’s Policies: Familiarize yourself with Cash App’s terms of service and dispute resolution guidelines.

- Be Prepared for a Potentially Lengthy Process: Cash App disputes can take time to resolve, so patience is key.

Step-by-Step Guide: How to Dispute a Cash App Transaction

Here’s a detailed guide on how to initiate a Cash App dispute:

- Open the Cash App application on your mobile device.

- Tap the “Activity” tab: This is typically represented by a clock icon at the bottom of the screen.

- Locate the transaction you wish to dispute: Scroll through your transaction history to find the specific transaction.

- Tap on the transaction: This will open the transaction details screen.

- Tap the three dots (…) in the upper-right corner: This will open a menu of options.

- Select “Need Help & Cash App Support”: This option will direct you to Cash App’s support resources.

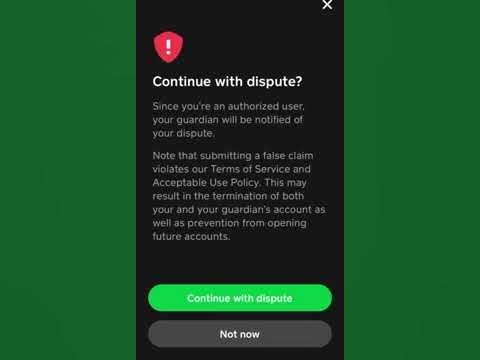

- Choose “Dispute this Transaction”: You may need to scroll down to find this option.

- Follow the on-screen prompts: Cash App will guide you through the dispute process, asking for details about the reason for the dispute.

- Provide a detailed explanation: Clearly and concisely explain why you are disputing the transaction. Include all relevant information and evidence. For example, “I was charged $50 for a service I never received. I contacted the vendor, and they have not responded to my requests for a refund.”

- Upload supporting documentation: Attach any relevant screenshots, receipts, or communication logs that support your claim.

- Submit your dispute: Once you have completed all the steps, submit your dispute to Cash App.

What Happens After You File a Dispute?

After submitting your dispute, Cash App will investigate the claim. This may involve contacting the recipient of the transaction and requesting information from them. Cash App will review the evidence provided by both parties and make a determination based on their findings. The timeframe for resolving a dispute can vary, but it typically takes several business days or even weeks. You can check the status of your dispute in the “Activity” tab of your Cash App account.

Common Reasons for Disputing a Cash App Transaction

There are several valid reasons for disputing a Cash App transaction. Here are some of the most common:

- Unauthorized Transactions: If you notice a transaction that you did not authorize, you should immediately dispute it. This could be due to fraud or unauthorized access to your account.

- Incorrect Amount: If you were charged the wrong amount, you have grounds for a dispute. For example, if you were charged $100 instead of $10.

- Goods or Services Not Received: If you paid for goods or services that you never received, you can dispute the transaction. This is common in online transactions where the seller fails to deliver the promised product or service.

- Defective Goods or Services: If you received defective goods or services, you may be able to dispute the transaction. However, you will likely need to provide evidence of the defect, such as photos or videos.

- Duplicated Transactions: If you were charged twice for the same transaction, you should dispute one of the transactions.

- Scams and Fraud: If you believe you were the victim of a scam or fraud, you should immediately dispute the transaction and report the incident to Cash App and law enforcement.

Maximizing Your Chances of a Successful Dispute

While there’s no guarantee of a successful outcome, you can take steps to improve your chances of winning your Cash App dispute:

- Act Quickly: Time is of the essence. The sooner you file a dispute, the better.

- Provide Detailed Information: Be as specific as possible when explaining the reason for your dispute. Include dates, times, amounts, and any other relevant details.

- Gather Compelling Evidence: The more evidence you can provide, the stronger your case will be. This could include screenshots, receipts, emails, and communication logs.

- Be Polite and Professional: Maintain a polite and professional tone when communicating with Cash App support.

- Follow Up Regularly: Check the status of your dispute regularly and follow up with Cash App support if you haven’t received an update in a timely manner.

- Consider Legal Options: If you are unable to resolve the dispute through Cash App, you may want to consider legal options, such as filing a small claims lawsuit.

Cash App Scams and How to Avoid Them

Cash App’s popularity has unfortunately made it a target for scammers. Being aware of common scams can help you protect yourself from financial loss.

Common Cash App Scams

- The “Cash Flipping” Scam: Scammers promise to multiply your money if you send them a small amount. This is a classic pyramid scheme and should be avoided at all costs.

- The “Romance Scam”: Scammers build a romantic relationship with their victims online and then ask for money for various fabricated reasons.

- The “Rental Scam”: Scammers list fake rental properties online and ask for a deposit or rent payment through Cash App.

- The “Fake Payment” Scam: Scammers send fake payment confirmations to trick victims into sending them money.

- The “Customer Support” Scam: Scammers impersonate Cash App customer support representatives and ask for your login credentials or other sensitive information.

Tips for Avoiding Cash App Scams

- Only send money to people you know and trust.

- Be wary of unsolicited requests for money.

- Never share your Cash App login credentials with anyone.

- Verify the identity of anyone you are sending money to.

- Be skeptical of deals that seem too good to be true.

- Report any suspected scams to Cash App immediately.

Cash App Customer Support: Your Resource for Assistance

Cash App offers various customer support channels to assist users with their questions and concerns. Knowing how to access these resources can be invaluable when dealing with a dispute or other issues.

Accessing Cash App Support

- In-App Support: The easiest way to contact Cash App support is through the app itself. Tap the profile icon, scroll down to “Support,” and select the relevant topic.

- Email Support: You can also contact Cash App support via email. However, response times may be longer than in-app support.

- Phone Support: Cash App offers limited phone support. Check the Cash App website or app for the current phone number.

- Social Media: While not ideal for sensitive issues, you can sometimes get a response from Cash App on social media platforms like Twitter.

Preparing to Contact Support

When contacting Cash App support, be prepared to provide the following information:

- Your Cash App username ($Cashtag).

- The transaction date and amount.

- A detailed explanation of the issue.

- Any supporting documentation.

Understanding Cash App’s User Agreement and Dispute Policies

Cash App’s user agreement outlines the terms and conditions of using the platform, including its dispute policies. Familiarizing yourself with these documents can provide valuable insights into your rights and responsibilities as a Cash App user.

Key Sections of the User Agreement

- Dispute Resolution: This section details the process for resolving disputes, including the time limits for filing a claim and the information required.

- Liability: This section outlines Cash App’s liability for losses incurred by users.

- Prohibited Activities: This section lists activities that are prohibited on Cash App, such as fraud and illegal transactions.

Staying Informed About Policy Changes

Cash App’s user agreement and dispute policies are subject to change. It’s important to stay informed about any updates or revisions. Check the Cash App website or app regularly for announcements and policy changes.

Alternatives to Cash App for Secure Transactions

While Cash App is a popular payment platform, it’s not the only option available. Exploring alternative platforms can provide additional security and features for your transactions.

Popular Alternatives to Cash App

- PayPal: PayPal offers robust fraud protection and dispute resolution mechanisms.

- Venmo: Venmo, owned by PayPal, is another popular option for sending and receiving money.

- Zelle: Zelle is a bank-backed platform that offers fast and secure transfers.

- Google Pay: Google Pay allows you to send and receive money through your Google account.

- Apple Pay: Apple Pay is integrated into Apple devices and offers secure payments using your credit or debit cards.

Comparing Security Features

When choosing a payment platform, consider the security features offered. Look for platforms that offer fraud protection, dispute resolution mechanisms, and encryption to protect your financial information.

Expert Insights on Managing Your Cash App Account Securely

Maintaining a secure Cash App account is paramount to preventing fraud and unauthorized access. Here are some expert tips to enhance your account security:

Implementing Strong Security Measures

- Enable Two-Factor Authentication: This adds an extra layer of security by requiring a code from your phone in addition to your password when logging in.

- Use a Strong, Unique Password: Avoid using easily guessable passwords or reusing passwords from other accounts.

- Monitor Your Account Activity Regularly: Check your transaction history frequently for any suspicious activity.

- Be Cautious of Phishing Attempts: Be wary of emails or messages that ask for your Cash App login credentials or other sensitive information.

- Keep Your App Updated: Regularly update your Cash App to ensure you have the latest security patches.

Navigating Financial Disputes Effectively

Understanding how to dispute a Cash App transaction is a vital skill in today’s digital landscape. By following the steps outlined in this guide, gathering compelling evidence, and maintaining clear communication, you can significantly increase your chances of a successful resolution. Remember that while Cash App provides a convenient way to send and receive money, it’s crucial to remain vigilant and proactive in protecting your financial security. By staying informed about potential scams and implementing strong security measures, you can confidently use Cash App while minimizing the risk of financial loss. Protecting your digital assets requires diligence, but the peace of mind is invaluable.