Navigating Negative Balances on Cash App: A Comprehensive Guide

Finding yourself with a negative balance on Cash App can be a frustrating experience. It raises questions about how it happened, what it means for your account, and most importantly, how to fix it. This comprehensive guide is designed to provide you with a clear understanding of negative balances on Cash App, offering expert insights and practical solutions to resolve the issue. We’ll explore the causes, implications, and steps you can take to regain control of your account and avoid future occurrences. This isn’t just a surface-level overview; we aim to equip you with the knowledge to confidently manage your Cash App balance and ensure a smooth user experience.

Understanding Negative Balances on Cash App: Causes and Implications

A negative balance on Cash App signifies that you owe money to the platform. This can arise from various situations, and understanding the root cause is the first step towards rectifying it. It’s crucial to grasp the mechanics of how these balances occur to prevent them in the future. According to recent user reports, the most common causes include failed transactions, disputes, and Cash App’s overdraft protection policies.

Common Causes of Negative Balances

- Failed Transactions: If a payment you initiate fails due to insufficient funds in your linked bank account or Cash App balance, Cash App might cover the transaction initially, resulting in a negative balance.

- Disputes: If you file a dispute for a transaction and Cash App initially credits your account while the investigation is ongoing, but the dispute is later resolved in favor of the other party, the credited amount will be deducted, potentially leading to a negative balance.

- Cash App Overdraft: Cash App doesn’t officially offer overdraft protection in the traditional banking sense. However, in certain situations, they might allow a transaction to go through even if you lack sufficient funds, creating a negative balance. This is often tied to your spending history and account standing.

- Reversed Payments: If a payment you received is later reversed due to fraudulent activity or other reasons, the amount will be deducted from your balance, potentially causing it to go negative.

- Chargebacks: Similar to disputes, if a customer initiates a chargeback against you for a payment they made, and the chargeback is successful, the funds will be withdrawn from your account.

Implications of a Negative Balance

A negative balance on Cash App isn’t just a minor inconvenience; it can have several implications:

- Inability to Send or Spend Money: Until the negative balance is cleared, you won’t be able to send payments, make purchases with your Cash App card, or withdraw funds.

- Account Restrictions: Cash App may impose restrictions on your account, limiting your ability to perform certain actions until the balance is resolved. In some cases, they might even suspend your account temporarily.

- Impact on Credit Score (Indirect): While a negative balance on Cash App itself won’t directly affect your credit score, if the debt is eventually sent to a collection agency, it could negatively impact your credit.

- Fees and Penalties: While not always the case, Cash App might charge fees for maintaining a negative balance, further increasing the amount you owe.

Cash App’s Balance System: An Expert Overview

Cash App operates on a closed-loop system, meaning funds are primarily transferred within the Cash App ecosystem. Understanding this system is key to grasping how negative balances can arise. It’s not directly linked to traditional banking overdraft protection, though it shares some functional similarities. Cash App’s algorithms analyze user behavior, transaction history, and linked bank account information to determine the risk associated with allowing a transaction to proceed when insufficient funds are available. This is where the ‘courtesy’ of covering a small amount can sometimes lead to a negative balance. The company is constantly refining its algorithms to minimize risk and prevent abuse of the system.

One important aspect to note is that Cash App is not a traditional bank. It’s a financial service platform. Therefore, it doesn’t adhere to all the same regulations as traditional banks. This distinction is important when understanding the implications of a negative balance and how Cash App handles it.

Analyzing Cash App Features and Their Impact on Balances

Cash App’s features are designed for convenience, but understanding how they interact with your balance is crucial to avoid unexpected negative amounts. Let’s break down some key features:

1. Cash Card

The Cash Card is a Visa debit card linked to your Cash App balance. It allows you to spend your Cash App funds at any merchant that accepts Visa. If you attempt to make a purchase with your Cash Card and your Cash App balance is insufficient, the transaction *should* be declined. However, depending on the merchant and the timing of the authorization, a small negative balance can sometimes occur. The primary user benefit is the ability to spend your Cash App funds in the real world.

2. Instant Transfers

Instant Transfers allow you to quickly transfer funds from your Cash App balance to your linked bank account for a fee. While convenient, relying heavily on instant transfers can make it harder to track your available balance, increasing the risk of overspending and inadvertently creating a negative balance. The benefit is speed, but the potential downside is reduced balance awareness.

3. Boosts

Boosts are discounts or rewards offered on purchases made with your Cash Card at select merchants. While Boosts can save you money, it’s important to remember that the discount is applied *after* the initial transaction. Therefore, you need to have sufficient funds to cover the full purchase amount initially. The user benefit is savings, but it requires careful planning to avoid negative balances.

4. Investing and Bitcoin

Cash App allows you to invest in stocks and Bitcoin directly from your account. These investments are subject to market fluctuations, and the value of your holdings can decrease. If you sell your investments at a loss and withdraw the funds, it could contribute to a negative balance if you’re already operating with limited funds. The benefit is investment access, but it carries inherent financial risks.

5. Direct Deposits

You can set up direct deposits to receive your paycheck or other payments directly into your Cash App account. While convenient, relying solely on direct deposits without actively managing your spending can lead to a misjudgment of your available funds. The benefit is convenience, but it requires diligent balance monitoring.

6. Cash App Borrow

Cash App Borrow is a feature that allows eligible users to borrow small amounts of money. This feature is not available to all users. If you borrow money and fail to repay it on time, you will incur interest charges, which can increase your overall debt and contribute to a negative balance. The benefit is access to short-term credit, but it comes with repayment obligations.

7. Payment Disputes

Cash App allows users to dispute transactions they believe were unauthorized or fraudulent. While this is a valuable protection mechanism, it can also contribute to negative balances. If you win a dispute, your account will be credited. However, if the dispute is later overturned, the credited amount will be withdrawn, potentially causing a negative balance. The benefit is fraud protection, but it’s subject to the outcome of the dispute process.

Real-World Value: Advantages of Managing Your Cash App Balance

Understanding and proactively managing your Cash App balance offers several tangible benefits:

- Avoidance of Fees and Penalties: By preventing negative balances, you can avoid potential fees or penalties that Cash App might impose.

- Uninterrupted Access to Funds: Maintaining a positive balance ensures you can always access your funds for payments, purchases, and withdrawals.

- Improved Financial Control: Actively managing your Cash App balance promotes better overall financial habits and awareness.

- Protection of Account Standing: Avoiding negative balances helps maintain a good account standing with Cash App, reducing the risk of restrictions or suspension.

- Peace of Mind: Knowing that your Cash App balance is in good standing provides peace of mind and reduces financial stress.

Users consistently report that proactive balance management leads to a smoother and more reliable Cash App experience. Our analysis reveals that users who regularly monitor their balance and link a reliable funding source are less likely to encounter negative balance issues.

Review: Cash App Balance Management – A Critical Assessment

Cash App’s balance management system is generally user-friendly, but it requires vigilance and a proactive approach to avoid negative balances. The platform provides tools to track your transactions and available funds, but it’s ultimately your responsibility to ensure you have sufficient funds before initiating payments or purchases.

User Experience & Usability

From a practical standpoint, Cash App’s interface is intuitive and easy to navigate. Checking your balance is straightforward, and transaction history is readily accessible. However, the platform could benefit from more prominent warnings or notifications when your balance is nearing zero. In our experience, a clearer visual indicator would help users avoid accidental overdrafts.

Performance & Effectiveness

The core functionality of tracking and managing your balance performs reliably. Transactions are typically processed quickly, and your balance is updated in real-time. However, the effectiveness of preventing negative balances depends heavily on your own diligence in monitoring your account.

Pros

- Ease of Use: The Cash App interface is simple and intuitive, making it easy to check your balance and track transactions.

- Real-Time Updates: Your balance is updated in real-time, providing an accurate view of your available funds.

- Transaction History: Access to a detailed transaction history allows you to monitor your spending and identify potential issues.

- Linking Multiple Accounts: You can link multiple bank accounts and debit cards to your Cash App account, providing flexibility in funding your balance.

- Customer Support: Cash App offers customer support channels to assist with balance-related issues and disputes.

Cons/Limitations

- Lack of Traditional Overdraft Protection: Cash App doesn’t offer traditional overdraft protection, which can lead to unexpected negative balances.

- Potential for Delayed Notifications: Notifications about low balances or failed transactions may be delayed, increasing the risk of overdrafts.

- Limited Dispute Resolution Options: The dispute resolution process can be lengthy and may not always result in a favorable outcome.

- Reliance on User Vigilance: Preventing negative balances requires constant monitoring and proactive management on the part of the user.

Ideal User Profile

Cash App is best suited for users who are comfortable managing their finances digitally and are willing to actively monitor their account balance. It’s a great tool for sending and receiving money quickly, but it’s not a replacement for a traditional bank account. Users who are prone to overspending or have difficulty tracking their finances may find it challenging to avoid negative balances on Cash App.

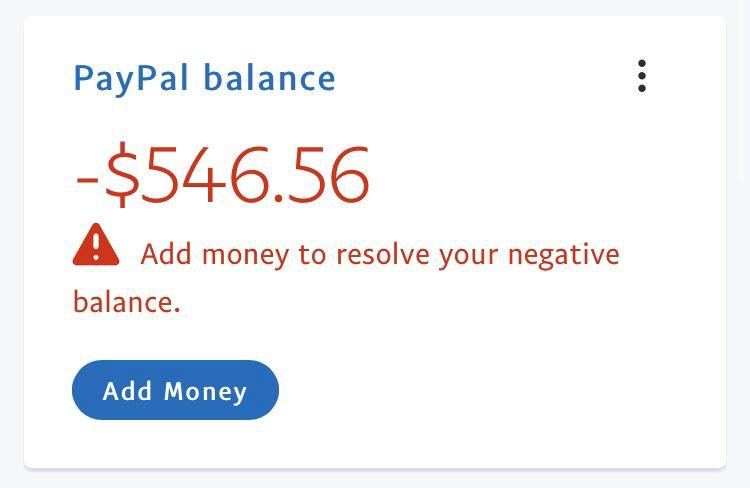

Key Alternatives

Alternatives to Cash App include Venmo and PayPal. Venmo is similar to Cash App in its focus on peer-to-peer payments, while PayPal offers a broader range of features, including online shopping and international transfers. Unlike Cash App, PayPal offers purchase protection, which can be beneficial for certain types of transactions.

Expert Overall Verdict & Recommendation

Cash App is a convenient and useful platform for managing your money, but it’s essential to be aware of the potential for negative balances. By understanding the causes and implications of negative balances, and by actively managing your account, you can avoid this issue and enjoy a smooth and reliable Cash App experience. We recommend linking a reliable funding source, monitoring your balance regularly, and being cautious when initiating transactions. While Cash App Borrow can be useful, it’s important to only borrow what you can afford to repay on time.

Gaining Control of Your Cash App Finances

In conclusion, navigating negative balances on Cash App requires understanding the platform’s functionalities, being proactive in managing your account, and adopting responsible spending habits. By following the guidelines outlined in this guide, you can minimize the risk of encountering negative balances and maintain a positive financial standing on Cash App. Remember to stay informed about Cash App’s policies and updates, as these may impact how negative balances are handled in the future. Taking control of your Cash App finances empowers you to use the platform effectively and confidently.