Weight Watchers Stock Forecast 2025: Expert Analysis and Predictions

Are you considering investing in Weight Watchers (WW) and want to know what the future holds? Predicting stock prices is never an exact science, but a thorough analysis of Weight Watchers’ performance, market trends, and future strategies can provide valuable insights. This comprehensive guide delves into the Weight Watchers stock forecast for 2025, providing an expert perspective on potential growth, challenges, and investment opportunities. We’ll explore the factors influencing WW’s stock, including its digital transformation, competition in the weight loss market, and overall economic conditions. By the end of this article, you’ll have a clearer understanding of the potential trajectory of Weight Watchers stock and whether it aligns with your investment goals.

Understanding Weight Watchers’ Business Model and Market Position

Weight Watchers, now known as WW International, has evolved significantly from its traditional focus on in-person meetings. Today, the company operates a multifaceted business model centered around digital subscriptions, personalized coaching, and nutrition programs. A key aspect of understanding the stock forecast is recognizing how these different facets contribute to revenue and growth.

The shift towards a digital-first approach has been crucial for WW. Digital subscriptions offer convenience and accessibility, attracting a broader audience. Personalized coaching, delivered through the WW app, provides tailored support and guidance, enhancing user engagement and retention. The company also offers nutrition programs and products, further diversifying its revenue streams. Understanding the interplay between these components is vital for assessing the company’s overall financial health and future prospects.

WW’s market position is also a critical factor. The weight loss industry is highly competitive, with numerous players vying for market share. WW faces competition from established brands like Jenny Craig and Nutrisystem, as well as a growing number of digital weight loss apps and programs. Furthermore, the rise of GLP-1 drugs like Ozempic and Wegovy presents a new challenge, potentially disrupting the traditional weight loss market. WW’s ability to differentiate itself and adapt to these evolving market dynamics will significantly impact its stock performance.

Factors Influencing the Weight Watchers Stock Forecast 2025

Several key factors will influence the Weight Watchers stock forecast for 2025. These include:

- Digital Subscription Growth: The continued growth of WW’s digital subscription base is crucial. The company needs to attract new subscribers and retain existing ones to drive revenue growth.

- Personalized Coaching Effectiveness: The effectiveness of WW’s personalized coaching program will impact subscriber satisfaction and retention. Positive outcomes and user testimonials can boost the program’s appeal.

- Competition from GLP-1 Drugs: The increasing popularity of GLP-1 drugs like Ozempic and Wegovy poses a significant threat to WW. The company needs to adapt its offerings to remain competitive in this changing landscape.

- Marketing and Brand Awareness: WW’s marketing efforts and brand awareness will play a key role in attracting new customers. Effective marketing campaigns can help the company stand out from the competition.

- Economic Conditions: Overall economic conditions can impact consumer spending on weight loss programs. Economic downturns may lead to reduced spending on discretionary items like WW subscriptions.

- Partnerships and Collaborations: Strategic partnerships and collaborations can expand WW’s reach and offerings. Collaborations with other health and wellness companies can create new opportunities for growth.

- Technological Advancements: The use of technology, such as AI and data analytics, can enhance WW’s personalized coaching program and improve user outcomes.

Analyzing Weight Watchers’ Financial Performance

A thorough analysis of Weight Watchers’ financial performance is essential for understanding its stock forecast. Key metrics to consider include:

- Revenue Growth: Tracking WW’s revenue growth over time provides insights into the company’s ability to attract and retain customers.

- Subscription Numbers: Monitoring the number of digital subscribers is crucial, as this is a key driver of revenue.

- Profit Margins: Analyzing WW’s profit margins reveals its ability to generate profits from its revenue.

- Debt Levels: Assessing WW’s debt levels is important, as high debt can pose a risk to the company’s financial stability.

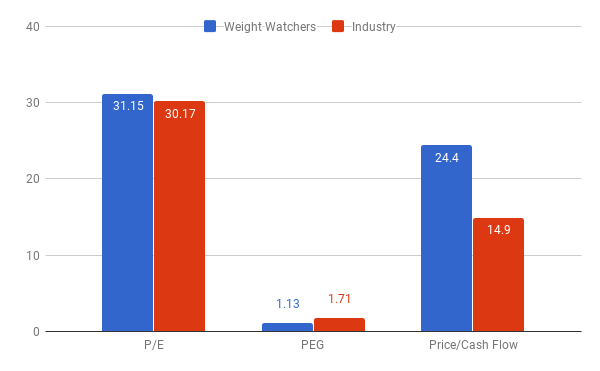

- Cash Flow: Monitoring WW’s cash flow provides insights into its ability to fund its operations and invest in future growth.

By examining these financial metrics, investors can gain a better understanding of WW’s financial health and its potential for future growth.

Expert Opinions on Weight Watchers Stock Forecast 2025

Financial analysts and investment firms regularly provide their opinions on the Weight Watchers stock forecast. These opinions are based on their analysis of the company’s financial performance, market trends, and future prospects. While these opinions should not be taken as definitive predictions, they can provide valuable insights for investors.

It’s important to note that expert opinions can vary widely. Some analysts may be bullish on WW, predicting strong growth and a positive stock forecast. Others may be bearish, citing concerns about competition or economic conditions. Investors should carefully consider these different perspectives and conduct their own research before making any investment decisions.

Staying informed about the latest expert opinions and analyst reports can help investors make more informed decisions about Weight Watchers stock.

Potential Scenarios for Weight Watchers Stock in 2025

Given the various factors influencing Weight Watchers’ stock, it’s helpful to consider potential scenarios for 2025:

- Best-Case Scenario: In a best-case scenario, WW successfully navigates the challenges posed by GLP-1 drugs, continues to grow its digital subscription base, and expands its partnerships and collaborations. This could lead to strong revenue growth and a positive stock forecast.

- Moderate Scenario: In a moderate scenario, WW maintains its current market position, experiences moderate growth in its digital subscription base, and adapts its offerings to remain competitive. This could result in stable revenue and a neutral stock forecast.

- Worst-Case Scenario: In a worst-case scenario, WW struggles to compete with GLP-1 drugs, experiences a decline in its digital subscription base, and faces economic headwinds. This could lead to declining revenue and a negative stock forecast.

By considering these different scenarios, investors can better assess the potential risks and rewards of investing in Weight Watchers stock.

Weight Watchers’ Response to GLP-1 Medications: A Key Factor

The emergence of GLP-1 medications like Ozempic and Wegovy has significantly altered the landscape of the weight loss industry. These drugs, originally developed for diabetes management, have proven highly effective for weight loss, presenting both a challenge and an opportunity for Weight Watchers.

WW’s response to these medications is a crucial factor in determining its future stock performance. The company has several options:

- Integration: WW could integrate GLP-1 medications into its existing programs, offering them as part of a comprehensive weight loss solution. This could involve partnering with healthcare providers to prescribe and monitor these medications.

- Differentiation: WW could focus on differentiating its offerings by emphasizing the long-term benefits of lifestyle changes, such as diet and exercise. This could appeal to individuals who prefer a more holistic approach to weight loss.

- Innovation: WW could invest in innovative new programs and technologies that complement or compete with GLP-1 medications. This could involve developing personalized nutrition plans based on genetic data or creating virtual reality experiences that promote healthy habits.

The success of WW’s response to GLP-1 medications will significantly impact its stock forecast for 2025 and beyond. A proactive and innovative approach could position the company for continued growth, while a reactive or complacent approach could lead to declining revenue and a negative stock forecast.

Weight Watchers’ Digital Transformation: A Closer Look

Weight Watchers’ digital transformation has been a key driver of its growth in recent years. The company’s digital offerings, including its app, personalized coaching, and virtual workshops, have made its programs more accessible and convenient for a wider audience.

The WW app is a central component of its digital strategy. It provides users with a range of features, including:

- Food Tracking: Users can track their food intake using the app’s extensive food database.

- Activity Tracking: Users can track their physical activity and earn activity points.

- Personalized Coaching: Users can connect with a certified WW coach for personalized support and guidance.

- Virtual Workshops: Users can participate in virtual workshops led by WW coaches.

- Community Support: Users can connect with other WW members for support and encouragement.

The effectiveness of WW’s digital transformation will continue to be a key factor in its stock forecast. The company needs to continuously innovate and improve its digital offerings to attract and retain customers.

Evaluating the Competition in the Weight Loss Market

The weight loss market is highly competitive, with numerous players vying for market share. Weight Watchers faces competition from established brands like Jenny Craig and Nutrisystem, as well as a growing number of digital weight loss apps and programs.

Key competitors include:

- Jenny Craig: Jenny Craig offers a combination of pre-packaged meals and personalized coaching.

- Nutrisystem: Nutrisystem also offers pre-packaged meals and personalized support.

- Noom: Noom is a digital weight loss app that focuses on behavioral change.

- MyFitnessPal: MyFitnessPal is a popular food tracking app that also offers personalized coaching.

- Calibrate: Calibrate is a weight loss program that combines GLP-1 medications with lifestyle coaching.

WW’s ability to differentiate itself from these competitors will be crucial for its stock forecast. The company needs to offer unique and compelling value propositions to attract and retain customers.

Risk Factors to Consider Before Investing in Weight Watchers

Before investing in Weight Watchers stock, it’s important to consider the potential risk factors:

- Competition: The weight loss market is highly competitive, and WW faces competition from established brands and emerging digital players.

- GLP-1 Medications: The increasing popularity of GLP-1 medications poses a significant threat to WW’s traditional weight loss programs.

- Economic Conditions: Economic downturns can impact consumer spending on weight loss programs.

- Debt Levels: WW has a significant amount of debt, which could pose a risk to its financial stability.

- Changing Consumer Preferences: Consumer preferences for weight loss programs are constantly evolving, and WW needs to adapt to these changes.

Investors should carefully consider these risk factors before making any investment decisions.

Making Informed Investment Decisions About WW Stock

Predicting the stock market is challenging, and forecasts are not guarantees. However, by understanding Weight Watchers’ business model, analyzing its financial performance, considering the factors influencing its stock, and evaluating the competition, you can make more informed investment decisions. The Weight Watchers stock forecast 2025 depends heavily on their ability to adapt to changes in the weight loss industry and consumer preference. It’s crucial to stay updated on the company’s latest developments and market trends to make the best choices for your investment portfolio. Remember to consult with a qualified financial advisor before making any investment decisions.